Black Money Eradication:

Prime Minister Narendra Modi chose to take everyone by surprise when he addressed the nation November 8, 2016 and announced that from midnight all Rs.1000 and Rs. 500 notes would be banned. These notes would be nothing but a piece of paper.

He said “All of us have to work shoulder to shoulder and create a prosperous, inclusive and corruption-free India.”

The announcement took everyone by surprise with many applauding the Prime Minister for taking the bold step to create a ‘corruption-free’ India.

Demonetisation of currency has been done once before in 1978 by the Indian Government during the tenure of Morarji Desai, when Rs. 1000, Rs, 5000 and Rs. 10,000 notes were withdrawn in a bid to tackle black money.

While, people could go to banks and post offices to exchange notes, the heavy turn down on sales and the inconvenience caused to elders standing in queue has been some of the main criticisms against the Minister’s sudden announcement.

Opposition United against the decision:

In the last few days, we have seen that the opposition has united against the decision taken against black money. Parties like SP and BSP called it a situation akin to emergency. They have posed several questions which they want Prime Minister Narendra Modi to answer in the house.

Mamta Banerjee and Arvind Kejriwal held joint protest at Delhi’s Azadpur Mandi. Senior Congress Party leader Anand Sharma said that the whole decision is a scam and a Joint Parliamentary Committee (JPC) must be set up to probe into the issue.

PM Modi seeks direct feedback from the people:

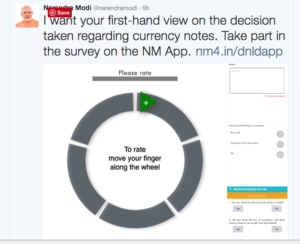

Amidst this ruckus, Prime Minister Narendra Modi has made a plea to seek direct feedback from the citizens of India about their opinion on the decision of demonetisation, through his newly released application called ‘NM.’ You can take part in the survey here.

He tweeted the following message:

The survey is in the form of ten questions. It is one of the best ways to show your support if you concur with the decision taken by out Prime Minister. Here is the link to the app again, nm4.in/dnldapp

What gives Prime Minister Narendra Modi the power to demonetise currency?

Apart from this, many have questioned the legality of the move.

The law under which currency was demonetised both this time as well as in 1978 is Section 26 of the Reserve Bank of India, Act 1934. Clause 2 of Section 26 is as follows:

(2) On recommendation of the Central Board the Central Government may, by notification in the Gazette of India, declare that, with effect from such date as may be specified in the notification, any series of bank notes of any denomination shall cease to be legal tender.

PIL before Madras High Court:

In fact, on 11th November, a PIL was filed before the Madurai Bench of the Madras High court challenging the decision of demonetisation. The petition was filed by Indian National League, State General Secretary, M Seeni Ahmed asking for the notes to be declared valid again.

However, the petition was dismissed stating it was a policy decision taken up for the welfare of the people.

PIL before Karnataka High Court:

On 11th November, a PIL against demonetisation of currency was also filed before the Karnataka High Court by Mohammad Haroon Rashid, an Advocate. However the bench headed by chief justice dismissed the petition station the move was important as a parallel economy was destroying the country.

PIL before Bombay High Court:

Two senior advocates Jamshed Mistry and Jabbar Singh moved the Bombay High Court on 9th November, 2016 to take up suo moto cognisance against the ban of Rs 500 and Rs 1000 notes as it was a rushed decision causing inconvenience to the public.

As the case was filed before the vacation bench, Justice Kartik directed the petitioner to file a case before the division bench as the case involved several questions of law. A proper petition is going to be filed by the petitioners, today, before the Division Bench of the Bombay High Court.

PIL filed before the Supreme Court:

An advocate from Delhi, Vivek Narayan Sharma filed a petition before the Supreme Court stating that the Notification of the Department of Economic Affairs as dictatorial for not granting enough time to the citizens.

Another lawyer from Uttar Pradesh, Sangam Lal Pandey has filed a petition against the move stating that it has affected emergency services and would affect those who have withdraw huge amount of money for marriages or farmers who have harvested crops.

The Supreme Court is going to hear the case on Tuesday, 15th November, 2016.

Opposition have also called for a debate on the demonetisation move in the Parliament’s winter session accusing the decision to be a ‘scripted scam’ that has caused hardship to the common people. This is going to be one debate to look forward to.

Steps taken by Prime Minister Modi to tackle black money in India:

The decision to demonetise currency has not been taken in haste. Quite clearly, it was a well thought out strategy to give people chances and hints before using the trump card at the end.

Narendra Modi swore in as the Prime Minister of India on 26th May, 2014. Ever since then Modi has taken strategic steps to eradicate black money from the system.

Below are the various initiatives that the Government took under Modi in order to eradicate black money from the economy.

May 2014:

Special Investigation Team:

On the very first day of his office, his new Government constituted a Special Investigation Team (SIT) to bring back black money stashed away in Swiss banks abroad. The SIT was headed by retired Supreme Court judge, Justice MB Shah and Arijit Pasayat as Vice-President.

The Swiss Government also extended the necessary support to the Government. The SIT had sought information on all cases of tax evasion and financial fraud being probed by various investigative agencies. However, the promise to bring back black money within 100 days that Narendra Modi’s Government had made failed to live up to the expectations.

Besides, Government was given time of one week on May 23, 2014 to establish to probe into the black money stashed in foreign banks. This had come up before the Supreme Court after Ram Jethmalani raised concerns over the damage of all documents related to black money, after Shastri Bhawan was set on fire.

Therefore, according to many establishment of SIT by the newly formed Government was just a compulsion more than a planned move.

Several recommendations were made by SIT:

- Action under anti-money laundering Act for trade based money laundering , putting a cap on huge cash transaction as these usually take place in activities such as drugs trade and betting.

- Specific recommendations to check black money transactions through cricket betting

- Check on generation of black money in educational institutions through donations to charity and religious institutions.

- Additional courts to decide pending cases under Income Tax Act.

- Check on money laundering by making use of exemption from long term capital gains etc.

However, SIT failed to achieve what it had set out to do.

August, 2014:

Pradhan Mantri Jan Dhan Yojana:

On August 28, 2014, he launched the Pradhan Mantri Jan Dhan Yojana. It was to ensure financial services including savings & deposit bank account, need based credit, remittances, insurance and pension for the weaker and lower income groups.

Under the scheme, 40 million bank accounts were opened in just one month. The scheme was clearly passed in pursuance of the next steps that were to follow.

May, 2015:

Undisclosed Foreign Income and Assets (Imposition of Tax) Bill received the President’s assent on May 26, 2015.

The Act provides for a host of situations. Some of them are:

(a) stringent measures including property confiscation against violation.

(b) It provides for 10 years of rigorous imprisonment in case of tax evasion and 300 percent of taxes on concealed income and assets.

(c) Concealment of income pertaining to foreign assets is charged with penalty three times the amount of tax over and above the flat rate.

(d) Failure to file returns is also punished etc.

However, I had discussed the loopholes of the same in one of my previous posts that you can access HERE.

May 2015:

Income Tax Act Amendments

The Government made amendments to Sections 296SS, 296T, 271D and 271E of the Income Tax Act.

According to the amendment made to Section 296SS, 100% penalty is levied if seller accepts an amount of Rs. 20,000 or more in cash from the buyer, while transacting immovable property.

Under Section 296T, even if the transaction is cancelled and the advance money is repaid in cash, 100% penalty shall apply.

June 2016:

Earlier tax was collected at source for gold jewellery bought in cash in excess of 2 lakhs at 1 percent. Bullion bought in cash in excess of 5 lakhs was taxed at 1 percent.

While, the same continued, Government also introduced 1 percent TCS for goods and services bought in cash exceeding an amount of two lakhs with an exception of jewellery.

August, 2016:

The Benami Transactions (Prohibition) Amendment Act, 2016

It received President’s Assent on August 11, 2016

Benami Transaction means a property bought by a person in the name of another person.

The Act provides that persons involved in such transaction will face an imprisonment of seven years.

Such properties shall be confiscated by the Government.

In the event, that false information has been furnished by a person, he shall face five years imprisonment.

Authorities for investigation were also established under the Act giving them power to confiscate and hold the property until the Adjudicatory authority passes an order.

September, 2016:

Income Declaration Scheme gave offenders one last chance to come out clean, with the last date being September 30, 2016. It opened on June 1, 2016 allowing people to declare undisclosed assets and escape any action against them on payment of 45% total tax.

Well, as citizens of India who have had long drawn out fight against black money, it is time we stand up with someone who has taken the risk to set things right.

Picture Courtesy: Pixabay