Goods and Service Tax (GST) Bill:

Unabating debates were held on Goods and Service Tax (GST) Bill between the Government and the opposition in the last few months. With the last parley consisting of seven rounds of discussion, the two parties have finally reached a consensus. The GST was successfully launched on 1st July 2017.

The Constitution (122nd Amendment) GST Bill, 2014 shall amend the Constitution to introduce Goods and Service Tax. The Parliament and the State legislatures shall have concurrent powers to make laws on GST.

Congress wanted the Constitution to provide a cap of 18% on the GST rate, which it decisively gave up. However, the stipulation of the Congress to do away with 1% tax to compensate the manufacturing states has been accepted in the meeting of the Empowered Committee of State Finance Ministers.

Apart from this, the Bill will also provide 100% compensation to the manufacturing states in the first three years, 75% in the fourth year and 50% in the fifth year.

GST Act includes a dispute resolution clause, which sets up a GST Council to hear all cases of dispute between Centre and State. It shall have representation from both Centre and States.

What is Goods and Service Tax?

Goods and Service Tax (GST) is a value added tax levied on both goods and services which is to replace all other indirect taxes. That means it will replace CENVAT, central sales tax, state sales tax, VAT, entry tax etc.

Quite plainly, GST would abolish the multiple taxes and bring in uniformity and simplicity in the taxation, thus avoiding double taxation as well.

GST is basically a two tier structure, where in tax is levied for intra-state transactions by:

(i) Centre, Central Goods and Service Tax (CGST) and

(ii) State, State Goods and Service Tax (SGST)

Centre levies Inter-State Goods and Service Tax (IGST) in case of inter-state transactions.

GST will also be applicable on import of goods. It is a two rate structure, lower rate for necessary items and a special rate for precious metals and items listed in the exception.

Why Goods and Service Tax?

Goods and Service Tax is a value added tax that will be borne by the customer. Even though GST is collected at each step of the sale and purchase chain, the manufacturer/wholesaler/retailer/ can claim it back through credit mechanism.

So the advantage of Goods and Service Tax is that:

(i) One avoids double taxation, which was the case in the multiple indirect taxes that we have at present. This means simpler paper work, easier accounting and preservation of time and money.

(ii) GST will be a single tax that will be levied on all goods and services offered and the rate shall be standard across various and goods and services.

(iii) GST allows everyone in the supply chain except the last to take tax credits.

(Assuming GST is collected at 5%)

| Goods | Input Cost | Sale Price | GST Collected |

| A weaver sells a fabric for Rs.100 per meter. | 0 | 100 | 100*5/100 = 5 |

| The tailor makes a skirt out of the fabric and sells it for Rs. 200 | 100 | 200 | 200*5/100 = 10 (out of which Rs. 5 will be collected by the weaver as tax credit) |

| The retailer then sells the skirt for Rs. 500 | 200 | 500 | 500*5/100 = 25

(out of which Rs. 10 will be collected by the tailor as tax credit) |

| Consumer | 0 | 0 | Will pay 25 as GST with no tax credit |

(iv) Encourage Competitive Pricing: As the simpler structure results in lesser payment of tax by the end consumer, it leads to boost in consumption encouraging competitive pricing.

(v) Increase in Revenue for the Government: This simpler tax structure and the advantage of tax credit increases compliance, in turn increasing tax revenue for the Government.

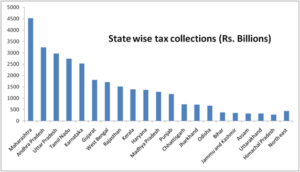

(vi) GST will help in collection of more money in the under-developed states. This is because until now all states collected different amount of taxes due to which some states like Uttarakhand, Assam etc collected lesser tax.

Therefore, GST is considered to be one of the most indispensable tax reforms in India. The system is being followed by 140 countries with France being the first having introduced it in 1954.

GST Rates:

India has set new rates for the Goods and Service Tax (GST) system. It is divided into four slabs ranging from 5% to 28%, with 12% and 18% as standard rates. These standard rates for most goods and services keep the tax incidence around the existing tax rates.

Common man is protected by taxing essential items including food at 0% rate. Common use items are to be taxed at 5% from the expected 6%. Actual benefit will only be clear once the items included in each category is revealed.

Luxury goods will be taxed at 28% making the over all tax burden even more than the present 30-31% as GST will be charged at the final stage while excise duty is charged at the intermediary stage. Moreover, products such as luxury cars and aerated drinks will attract additional cess on top of the 28% tax rate.

Experts have criticised the levy of additional cess as it leads to a step back from the GST structure defeating the purpose that GST regime had set out to achieve.

The Government said that the money collected through additional cess as well as the clean energy cess would be used as revenue pool to compensate states that have suffered a revenue loss during the last five years. Finance Minister pointed out that the average tax is less than 18% proposed by the Congress.

Updates:

With GST roll out on July 1, 2017, the Ministry of Finance notified the rates of tax on each product vide Notification No.1/2017. On the same day, certain products that do not attract any tax on intra-state supplies were also notified vide Notification No. 2/2017.

Post these notification, many raised queries on the meaning of ‘registered brand name’ as the notifications mention that certain products that are put up in unit container and have registered brand name attract tax while the ones that are not do not attract any tax. Therefore, the government released a clarification in this regard on 5th July 2017.

Further, there is a move to follow the Harmonised System of Nomenclature (HSN) for goods and the Service Accounting Code (SAC) system for services. HSN or HS (Harmonised Commodity Description and Coding System) is a multipurpose international product nomenclature developed by the World Customs Organization (WCO). Similar to HSN, SAC system is adopted for services. HSN Codes and rates of goods can be found here. SAC codes and rates of services can be found here.

Picture Credit: Flickr

There Are 5 Comments