Now, fight against Benami Property:

After a full-grown attack on black money by the Modi Government by way of demonetization, it looks like the government is now ready to take on benami transactions. It is a well known fact that properties have been safe haven of a lot of black money and corruption has subsisted through a series of real estate transactions.

Benami really means property without a name. The person who buys the property does not buy it in his/her name. The person in whose name the property has been purchased is called benamidar and the property is called benami property. The person who pays for the property is the real owner.

However, the exceptions to benami properties are as follows:

- if the property is held in the name of spouse/child

- if it is a joint ownership

- in case of a property held in fiduciary capacity, and if in all such cases transaction is paid for through known sources of income.

- General Power of Attorney if stamp duty is paid and the document is registered.

- If Karta of HUF (Hindu Undivided Family) buys property for the benefit of the trustee.

- Benami property disclosed under Income Declaration Scheme, 2016.

History of Benami Laws in India:

The President of India had promulgated an Ordinance on May 19, 1988 in relation to benami transactions in exercise of the powers conferred under Article 123(1) of the Indian Constitution.

The Ordinance was promulgated based on the recommendations of the Law Commission of India to examine the methods of prohibiting benami transactions. The Law Commission had made the report on the suggestion made by the Minister for Law, Justice and Company affairs by his letter dated December 20, 1972.

As the Benami properties have been an issue to the taxing authority as well, Select Committee for the Taxation Law (Amendment) Bill, 1969 had suggested government to examine law relating to benami transactions. This was reiterated during the debate on Taxation Laws (Amendment) Bill, 1971.

Laws on Benami Transactions:

Accordingly, The Benami Transactions (Prohibition) Act, 1988 was passed which was to come in force on 19th May 1988. However, due to several loopholes such as lack of appellate authority, lack of provision for vesting confiscated property with the Centre, the Act was not notified and the rules were not framed.

Benami Transactions (Prohibition) Bill, 2011 was passed by the UPA Government in order to replace the 1988 Act. However, the bill lapsed with the dissolution of 15th Lok Sabha. Therefore, even though we had an Act passed against benami transaction in 1988, it has been ineffective for more than 25 years.

Hence, the current government introduced Benami Transaction (Prohibition) Amendment Bill, 2015 in the Parliament on May 13th, 2016. The bill was referred to a Standing Committee, which submitted report on May 28th. The bill was passed by both houses of Parliament on July 27 and August 2. It came to be into force on 1st November, 2016.

As per Ministry of Finance, after the coming into effect of Benami Transactions (Prohibition) Amendment Act, 2016 (BTP Amendment Act), the The Benami Transactions (Prohibition) Act, 1988 shall be renamed as Prohibition of Benami Property Transactions Act, 1988 (PBPT Act).

The Bill was introduced in order to establish authority to confiscate benami property. Apart from this, the highlights of the amendment are as follows:

- The amendment provides upto 7 years imprisonment and fine of upto 25% of the value of the benami property for persons involved in benami transactions. Earlier it was 3 years imprisonment or fine or both.

- Furnishing false information will also lead to an imprisonment of 6 months to 5 years and a fine of upto 10% of the market value of the benami property.

- Four authorities have been set up to conduct inquiries. They are: (i) initiating officer (ii) Approving Authority (iii) Administrator (iv) Adjudicating Authority

The initiating officer will issue notice on suspicion and hold the property for 90 days subject to Approving Authority’s permission. After 90 days, the initiating officer may pass an order to continue holding the property and refer the case to Adjudicating Authority.

After the adjudicating authority passes an order on examining all the documents, the adjudicator will receive and handle the property as per prescribed conditions.

- Properties that are held benami and liable to be confiscated by the Government without any compensation.

- Appellate authorities have been set up under the Act in the form of Appellate Tribunal to hear appeals against the orders passed by the Adjudicating Authority. High Court will hear appeals against orders passes by Appellate Tribunal.

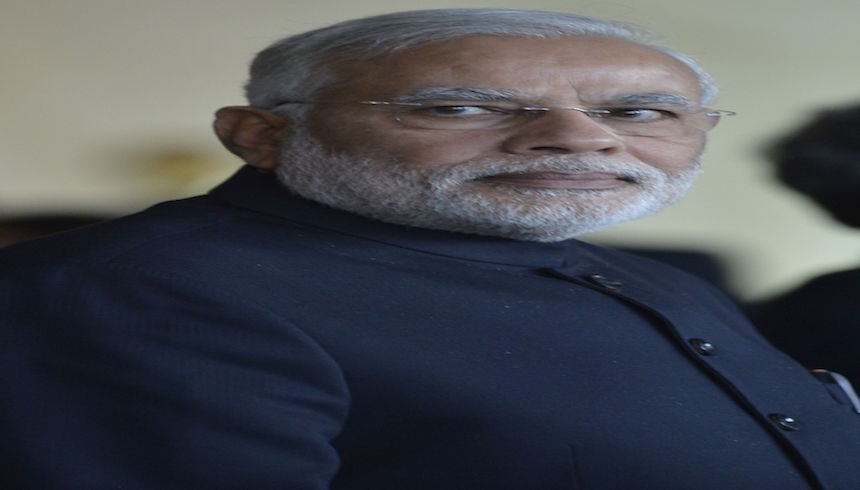

On Sunday, 25th December, 2016, Prime Minister Modi said that he would operationalise this law to tackle benami properties as part of their attack against black money and corruption. It remains to be seen how many cats are let out of the bag during this phase and whether the law would succeed in cleaning up the real estate sector.

Picture Courtesy: Wikimedia